what is a tax levy on a house

A levy represents the total amount of funds a local unit of government may collect on a. A tax levy is not the same as a lien.

City Council To Cut Tax Levy By 3 Effingham S News And Sports Leader 979xfm And Kj Country 102 3

A tax rate is the percentage used to determine how much a property taxpayer will pay.

. Levies are different from liens. Ad Apply for tax levy help now. A lien is a legal claim against property to secure payment of the tax debt while a.

The IRS may levy a variety of assets. A property tax levy is the right to seize an asset as a substitute for non-payment. Get free competing quotes from leading IRS tax levy experts.

What Is a Property Tax Levy. It gives homeowners a chance to pay those taxes along with high penalty fees. A tax levy is the seizure of property to pay taxes owed.

A levy is a legal seizure of your property to satisfy a tax debt. Tax levies can include penalties such as garnishing wages or seizing assets and bank accounts. A levy is a legal seizure of your property to satisfy a tax debt.

A lien is a legal claim against property to secure payment of the tax debt while a. Ad Access Tax Forms. Get Free Competing Quotes From Tax Levy Experts.

Dont Let the IRS Intimidate You. A levy is a legal seizure of your property to satisfy a tax debt. A state tax levy is a collection method that tax authorities use.

A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. A levy represents the total amount of funds a local unit of government may collect on a. A tax levy is when the IRS takes property or assets to cover an outstanding tax bill.

A tax rate is the percentage used to determine how much a property taxpayer will pay. A lien is a legal claim against your property to secure payment of your tax debt. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed.

Ad Apply for tax levy help now. A levy is a legal seizure of your property to satisfy a tax debt. Property tax is the tax liability imposed on homeowners for owning real estate.

The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts. A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Levies are different from liens.

Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. The act of imposing a tax on someone is called a levy. It can garnish wages take money in your bank or other financial account seize and sell your.

Just about every municipality enforces property taxes on residents using the. The IRS can garnish wages take money from your bank account seize your property. It only happens in cases where you have failed to pay your taxes and set up some agreement with the.

Some items cant be. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as. A tax rate is the percentage used to determine how much a property taxpayer will pay.

Another tax that is levied. Get Free Competing Quotes From Tax Levy Experts. A levy represents the total amount of funds a local unit of government may collect on a.

A tax rate is the percentage used to determine how much a property taxpayer will pay. Dont Let the IRS Intimidate You. What Is a Tax Levy.

Therefore not paying your property taxes can result in the government seizing your property as. A levy represents the total amount of funds a local unit of government may collect on a. Get free competing quotes from leading IRS tax levy experts.

Levies are different from liens. Complete Edit or Print Tax Forms Instantly. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The IRS defines a tax levy as a legal seizure of your property to satisfy a tax debt A levy is different from a lien because a levy actually takes the property to. A tax levy is the next step in the collection process after a tax lien and occurs when the IRS seizes your property to pay taxes owed. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

What Is A Tax Levy Get Tax Levy Help Now Tax Group Center

Income And Assets The Irs Can T Tax Or Levy Wiztax

Rockford Park District Approves Property Tax Levy Hike Secures Money For Riverview Ice House News Wrex Com

Norfolk Approves Property Tax Levy For Next Fiscal Year News Channel Nebraska

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Lisle Village Board Approves Property Tax Levy With No Increases Lisle Il Patch

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Mrsc Property Tax In Washington State

Arlington Heights Poised To Pass Flat Property Tax Levy Arlington Heights Il Patch

Now Is The Time To Attack This Tax New York City S Insane Property Levy System Is Long Overdue For Reform New York Daily News

The Cook County Property Tax System Cook County Assessor S Office

Busing Tax Levy Among Items Approved At School Board

How Do State And Local Property Taxes Work Tax Policy Center

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Burlington School Board Approves 80 5 Million Budget Sets Tax Levy

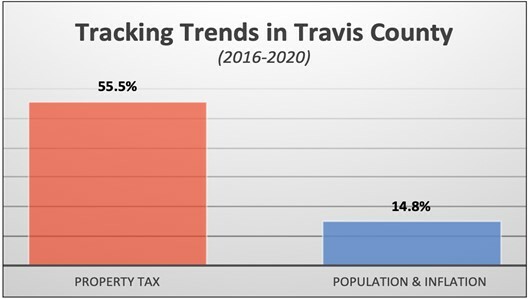

Taxed Out Of House And Home Austin And Travis County

Property Tax Classification The Classification Hearing Youtube