retroactive capital gains tax increase

Team Biden apparently wants to visit similar retroactive tax joy. Top earners may pay up to.

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

A Retroactive Capital Gains Tax Increase.

. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike. Then there is timing. Top earners may pay up to.

Biden plans to increase this. Jacob Rees-Mogg has hit out at plans to increase capital gains tax on Friday amid a mounting backlash against proposals to target investors and landlords. This resulted in a 60 increase in the capital.

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. Top earners may pay up to 434 on long-term capital. This resulted in a 60 increase in the capital gains tax collected in 1986.

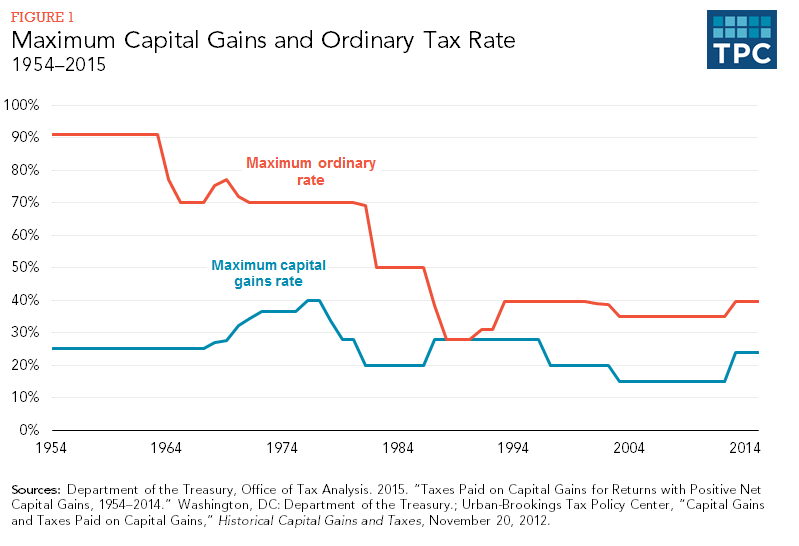

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million. Thats about 15 of all UK tax receipts.

Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. He Chancellor is looking at raising taxes on the sale of assets such as shares and property as he weighs up difficult decisions to address a 50 billion black hole in the public. In one of his first.

Retroactive Capital Gains Tax Hike. JD CPA PFS. There is currently a.

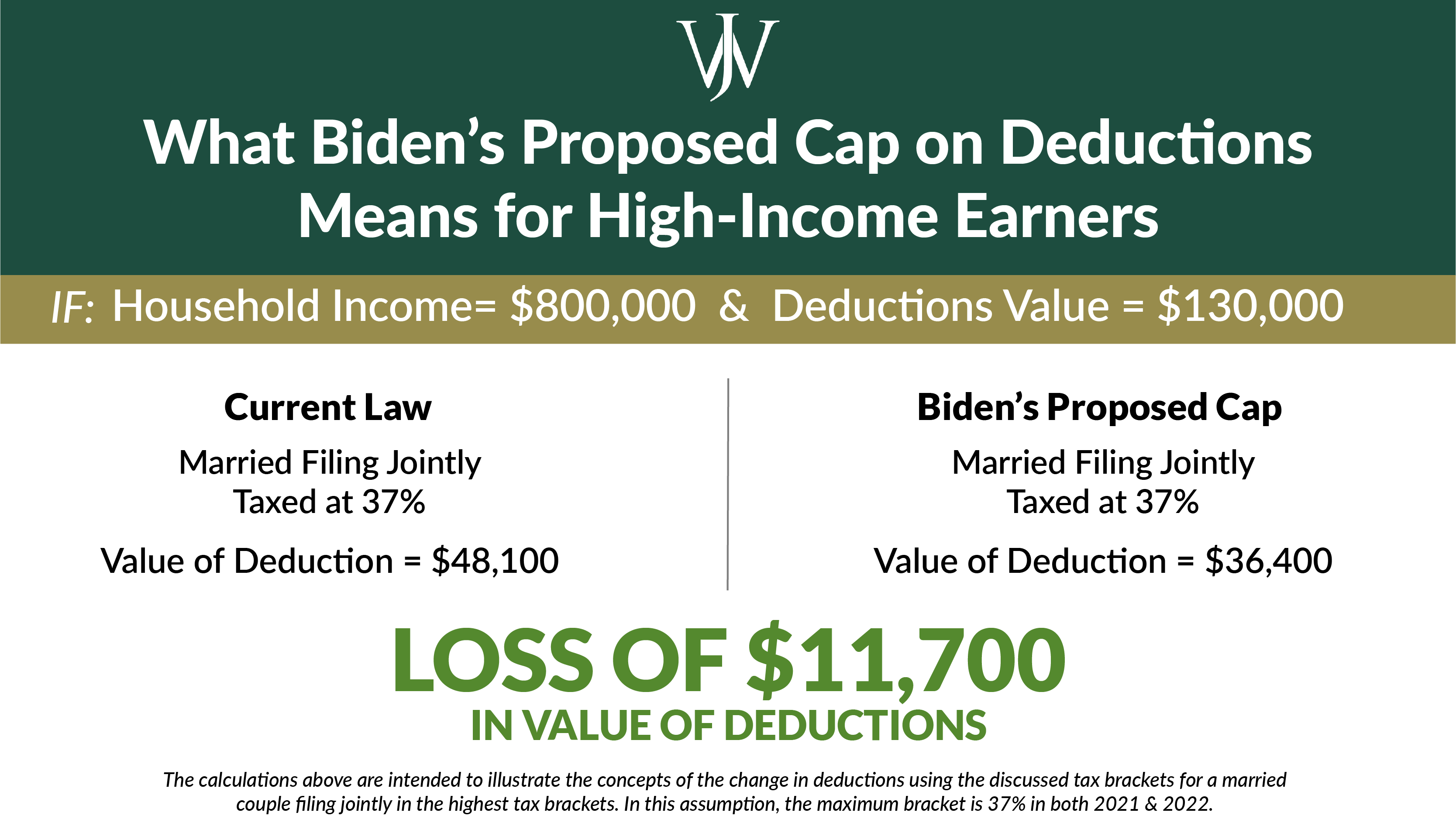

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. As proposed the rate hike is already in effect.

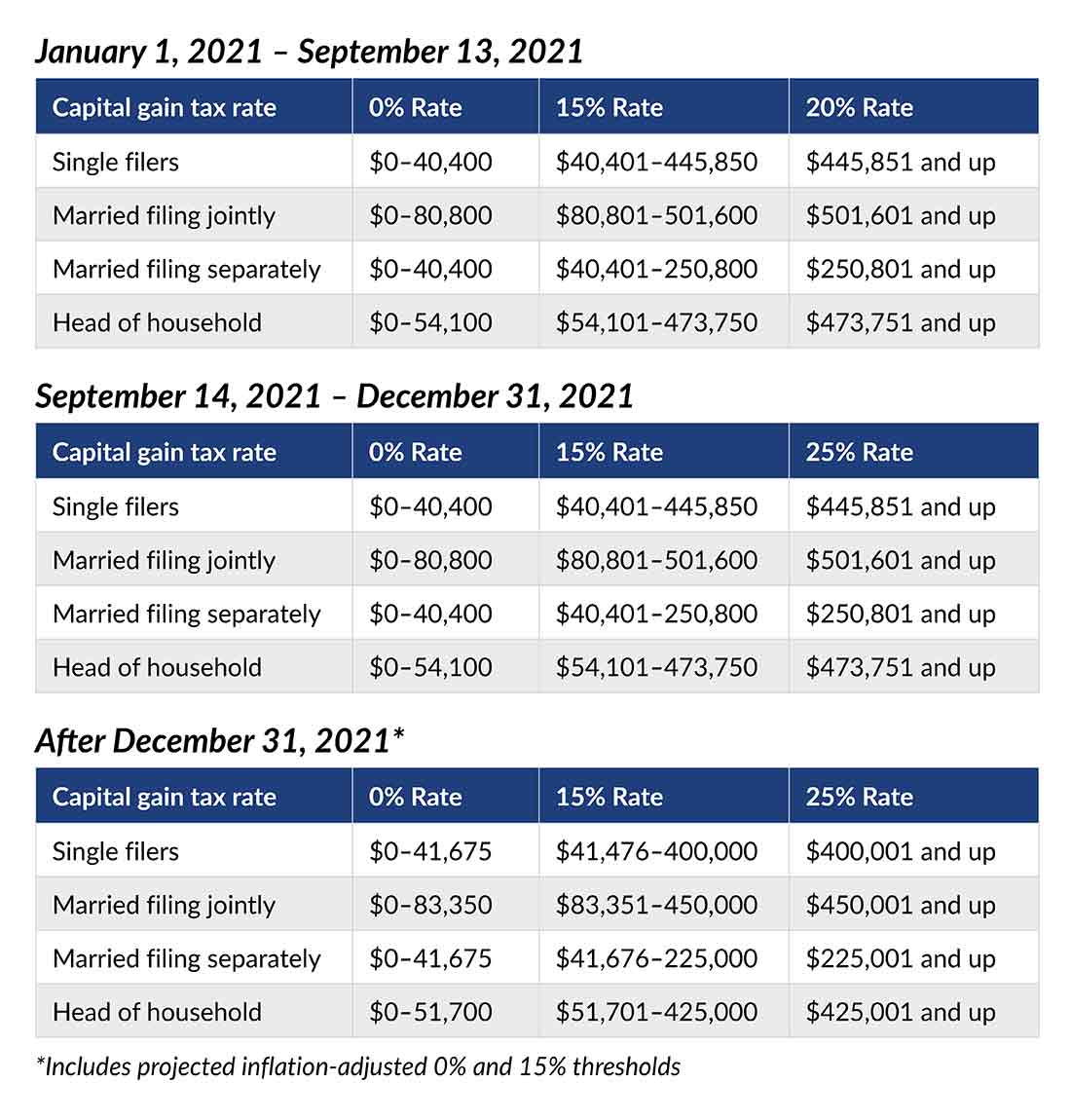

Biden plans to increase this. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate.

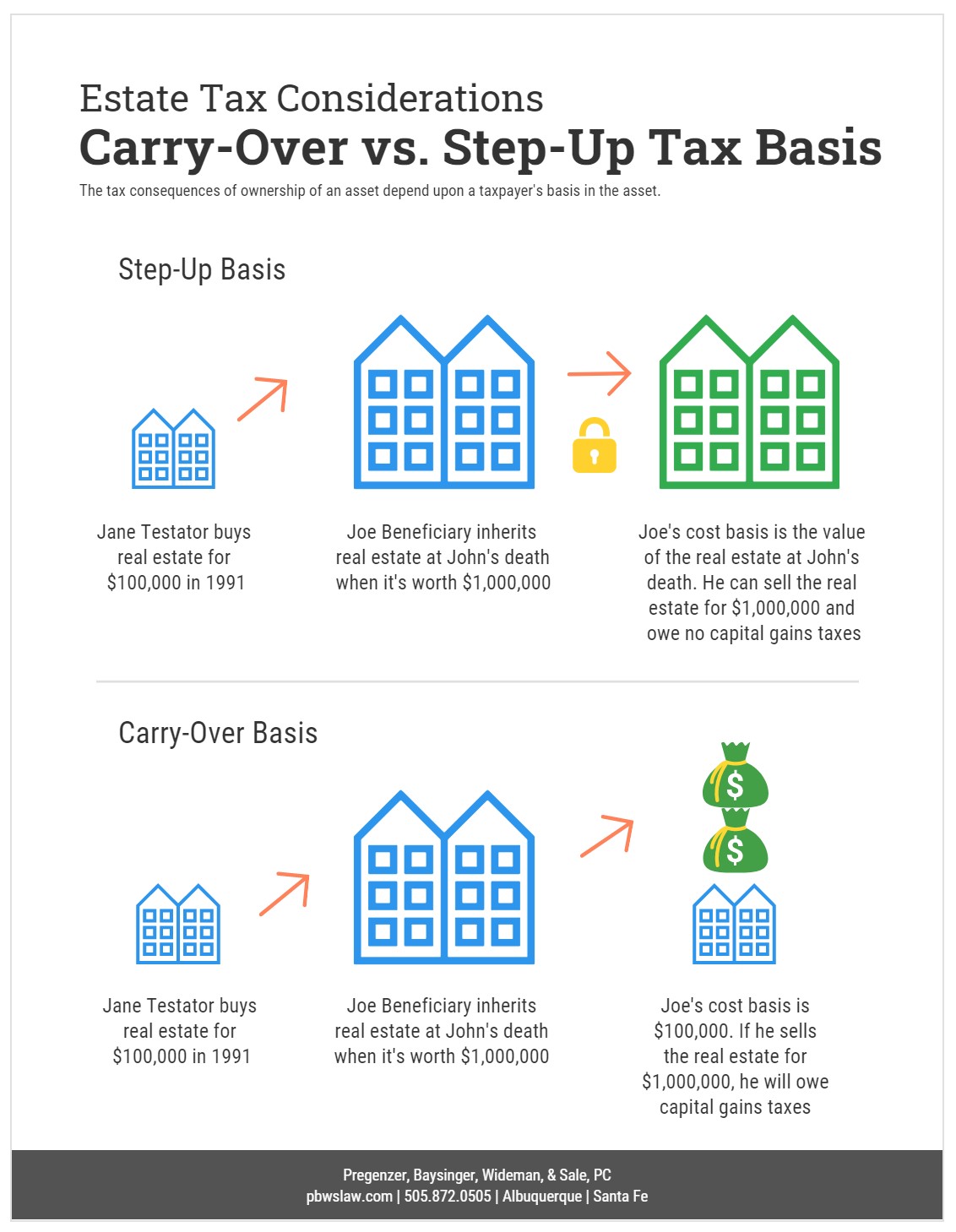

The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. A Retroactive Capital Gains Tax Increase.

Rise in capital gains tax on the cards as Chancellor Hunt scrambles to raise 50bn. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. While some Democrats have expressed concern about a capital gains increas See more.

President Biden really is a class warrior. But until a Wall Street Journal scoop published Thursday night it wasnt known that. A Retroactive Capital Gains Tax Increase.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

President Biden has been clear that he wants to raise taxes on capital gains for high earners. As the Chancellor is weighing up difficult decisions to address a 50bn black hole in the. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Capital Gains Full Report Tax Policy Center

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Estate Taxes Under Biden Administration May See Changes

Biden S Proposed Retroactive Capital Gains Tax Increase

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

Managing Tax Rate Uncertainty Russell Investments

Crystal Ball Gazing To The Past Article By Pearson Co

Can Congress Really Increase Taxes Retroactively

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Managing Tax Rate Uncertainty Russell Investments

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Just Released Retroactive Capital Gains Tax Hike 43 6

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call